Recent headlines confidently announced that the 33% reduction in U.S. new home sales for May 2010 was due to the expiration of the new-home buyer’s tax credit at the end of April.

Recent headlines confidently announced that the 33% reduction in U.S. new home sales for May 2010 was due to the expiration of the new-home buyer’s tax credit at the end of April.In other words, we are supposed to believe that home sales were robust due to an $8000 tax credit, and now that this credit is over the housing market is bust. Nonsense.

In fact, the reversal in new home sales was primarily caused by an equally large decline in psychological wealth that occurred at the beginning of May - which had nothing to do with tax credits.

Rapid declines in consumer spending are caused by rapid declines in asset values, such as stocks or real estate. While there is much talk about how a drop in stock prices can “predict” an economic downturn, there is little notice that a drop in stock prices, rather than predicting a downturn, may actually be the cause of one.

When people see their net worth decline, they compensate by saving. That is, they decrease their spending and increase their margin of safety, further exacerbating the symptoms of the decline.

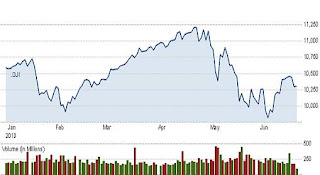

The “flash crash” of May 6th 2010 punched the confidence out of retail investors, psychologically forcing them to transfer billions of dollars out of equity investments. So, while April saw inflows to equity mutual funds of $13.89 billion, May saw outflows of $29.94 billion (www.ici.org). Negative headlines caused retail investors to run for the hills - and they haven’t stopped running. These days, the market fluctuates wildly from the trades of hedge funds and volume traders, while those working with retail clients (such as Financial Planners and Brokers) sit at their desks, bored.

Stocks are reasonably priced, with little room for a disastrous collapse like the one from the peak. Home prices are low. Interest rates are low. Despite problems in Europe and Asia, the U.S. economy has all the logical conditions which make it ready to rise from the ashes. However, retail investors and consumers are anything but logical.

Until the chat-room anger and gloom subsides, both stock and housing markets will linger - and the buying opportunities for rational long-term investors will be sublime.

____

“…the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time.”

The Federal Reserve, Press Release, June 23 2010

“Housing cannot lift the United States from its new state of Marxist depression, you bunch of morons. The American Dream is just that. Rest in Peace, USA.”

Anonymous comment on a financial news website, June 24 2010

____

See also: Reverse Attribution