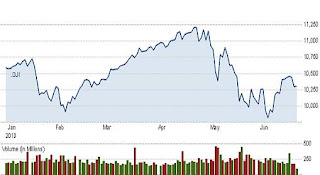

The same people who were clamouring for financial reform during the height of the crisis now appear to be taking a "if it's not broken don’t fix it" approach. Having seen their stocks go up since the lows of 2008, fear of change has taken hold. How can we be considering financial reform when talk of it makes markets drop? Don't the markets "know everything?"

The same people who were clamouring for financial reform during the height of the crisis now appear to be taking a "if it's not broken don’t fix it" approach. Having seen their stocks go up since the lows of 2008, fear of change has taken hold. How can we be considering financial reform when talk of it makes markets drop? Don't the markets "know everything?"Many conservatives have branded financial reform or regulation as "socialist" or "communist," making the ridiculous conclusion that since the highly-regulated communist structure didn't work, a complete lack of regulation must be best. Such short-term and narrow minded thinking is bad for the nation. Financial reform is necessary - and has been a long time coming:

__

"If we bail out this one (Penn Square Bank)...then the markets will know that, no matter what risks they take, the government will bail them out. Eventually, its going to lead down the road to nationalization of the banking system."

William Isaac, FDIC chairman, 1982

__

"If this sounds like a warning, it is."

Gerald Corrigan, President of the Federal Reserve Bank of New York, telling bankers that the over-the-counter (OTC) market seemed to be expanding without adequate controls, 1992

__

"Improved 'transparency' - a favorite remedy of politicians, commentators and financial regulators for averting future train wrecks – won't cure the problems that derivatives pose. I know of no reporting mechanism that would come close to describing and measuring the risks in a huge and complex portfolio of derivatives."

Warren Buffet, Berkshire Hathaway 2008 Annual Report

__

"A key question: Should we opt for even more pain now to gain a better future? For instance, should we create new controls to stamp out much sin and folly and thus dampen future booms? The answer is yes. Sensible reform cannot avoid causing significant pain, which is worth enduring to gain extra safety and more exemplary conduct."

Charles T. Munger, 2009, in the Washington Post

__

"A clear lesson of this crisis is that any strategy that relies on market discipline to compensate for weak regulation and then leaves it to the government to clean up the mess is a strategy for disaster."

Timothy Geithner, Secretary of the Treasury, 2010 in the Washington Post

__

"It is simply unacceptable to walk away from this recession without fixing the system's basic flaws that helped to create it."

Timothy Geithner, Secretary of the Treasury, 2010, in the Washington Post

__

"A clear lesson from the events of the past few years--and a recommendation in the report with which we strongly agree--is that the government must not be forced to choose between the unattractive alternatives of bailing out a systemically important firm or having it fail in a disorderly and disruptive manner. The government instead must have the tools to resolve a failing firm in a manner that preserves market discipline--by ensuring that shareholders and creditors incur losses and that culpable managers are replaced--while at the same time cushioning the broader financial system from the possibly destabilizing effects of the firm's collapse… The financial reform legislation in both the House and the Senate would provide for such a resolution regime."

Ben Bernanke, Chairman of the Federal Reserve, 2010, Fed Speech

__

In my estimation, one of the reasons people hate Obama is because he is forward thinking and logical, and therefore does things that voters hate (a rare combination in politics). In doing what's necessary, he successfully manages to piss off every possible segment of his support base. He makes poor people get health insurance coverage, even if they don't want it. He institutes financial reform at a time when the market is recovering and when each word from his mouth causes the market to drop. His logic, rather than his strict adherence to political philosophy, makes him "difficult" and "impossible to predict." Personally, I like the fact that Obama ignores popular opinion and just gets things done. No doubt he will be a one-term president.

Enemy of Business: no.

Enemy of dangerous, unregulated, pre-1929 style business: yes.

____

"Issues are never simple. One thing I'm proud of is that very rarely will you hear me simplify the issues."

Barack Obama